History

175 Years of Service

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit, sed quia consequuntur magni dolores eos qui ratione voluptatem sequi nesciunt. Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi tempora incidunt ut labore.

Bar Menu

Lorem ipsum dolor sit amet, consectetur adipisicing elit sed do eiusmod tempor

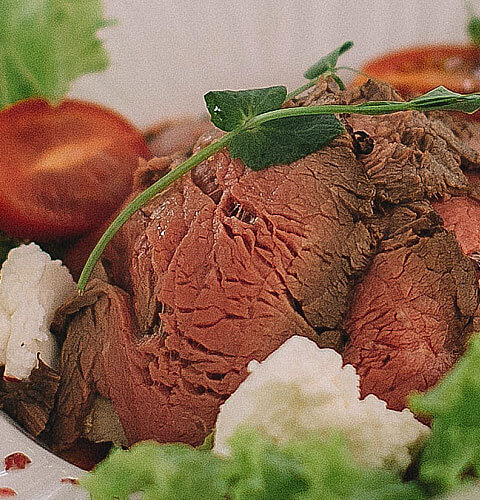

Food Menu

Lorem ipsum dolor sit amet, consectetur adipisicing elit sed do eiusmod tempor

Order Wine At

Your Doorstep

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod.